UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

| | |

| | | |

| | SCHEDULE 14A INFORMATION | |

| | | |

| PROXY STATEMENT PURSUANT TO SECTION 14(A) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 |

| (AMENDMENT NO. ____) |

| | | |

Filed by the Registrant x Filed by a Party other than the Registrant o¨

|

| | |

| Check the appropriate box: |

| | | |

o¨ | | Preliminary Proxy Statement |

| | |

o¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

ox | | Definitive Proxy Statement |

| | |

o¨ | | Definitive Additional Materials |

| | |

x¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

|

| AMBAC FINANCIAL GROUP, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

|

| | | | |

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| | | | | |

| x | | No fee required. |

| | |

o¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | | (1) | | Title of each class of securities to which the transaction applies: |

| | | (2) | | Aggregate number of securities to which the transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| | |

o¨ | | Fee paid previously with preliminary materials. |

| | |

o¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount previously paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

|

| |

| 2018 NOTICE OF ANNUAL |

| MEETING OF STOCKHOLDERS & |

| PROXY STATEMENT |

|

| |

| Ambac Financial Group, Inc. One State Street Plaza New York, NY 10004 Tel: 212.658.7470 |

|

| | | | |

| |

| April 5, 2018 |

| | | | |

| To Our Fellow Stockholders: |

| |

| It is our pleasure to invite you to our 2018 Annual Meeting of Stockholders to be held on May 18, 2018 at 11:00 a.m. (Eastern). The meeting will be held at our executive offices in New York City. |

| | | | |

| We are taking advantage of the Securities and Exchange Commission (“SEC”) rules that allow companies to furnish proxy materials to stockholders via the internet. This electronic process gives you fast, convenient access to the materials, reduces the impact on the environment and reduces our printing and mailing costs. If you received a Notice Regarding the Availability of Proxy Materials (“Internet Notice”) by mail, you will not receive a printed copy of the proxy materials unless you specifically request them. The Internet Notice instructs you on how to access and review all of the important information contained in this Proxy Statement, as well as how to submit your proxy over the internet. If you want more information, please see the General Information section of this Proxy Statement or visit the Annual Meeting of Stockholders section of our Investor Relations website at http://ir.ambac.com. |

| | | | |

| Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the internet or by phone or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction card. Please review the instructions on each of your voting options described in this Proxy Statement, as well as in the Internet Notice you received in the mail. |

| | | | |

| Thank you for your interest in Ambac. |

| | | | |

| Sincerely, | | | |

| | | | |

| Jeffrey S. Stein Chairman | | Claude LeBlanc President and Chief Executive Officer | |

AMBAC FINANCIAL GROUP, INC.

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

|

| | | | |

| | | | |

| Time and Date | | 11:00 a.m. (Eastern) on May 18, 2018 | |

| |

| Place | | Ambac Financial Group, Inc. One State Street Plaza, 16th Floor New York, New York 10004 | |

| | | |

| Items of Business | | (1) To elect seven members of the Board of Directors to hold office until the next annual meeting of stockholders or until their respective successors have been elected and qualified. | |

| | | (2) To approve, on an advisory basis, the compensation of our named executive officers. | |

| | | (3) To ratify the appointment of KPMG LLP as Ambac’s independent registered public accounting firm for the fiscal year ending December 31, 2018. | |

| | | |

| Adjournments and Postponements | | Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. | |

| | | |

| Record Date | | You are entitled to vote only if you were an Ambac stockholder as of the close of business on March 20, 2018 (Record Date). You will need proof of ownership of our common stock to enter the meeting. | |

| | | |

| Voting | | Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice Regarding the Availability of Proxy Materials(“Internet Notice”) you received in the mail, the section titled “General Information - Information About the Annual Meeting and Voting” in this Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy or voting instruction card. | |

| | | | |

| | | By order of the Board of Directors, |

| | | |

| | | William J. White |

| | | Corporate Secretary |

| | | | |

This notice of Annual Meeting and Proxy Statement and form of proxy are being distributed and made available on or about April 5, 2018.

|

| | | | | | |

| | | | | | | |

| | TABLE OF CONTENTS | |

| | PROXY STATEMENT SUMMARY | | | Compensation Discussion and Analysis | | |

| | GENERAL INFORMATION | | | Compensation Committee Report | | |

| | INCORPORATION BY REFERENCE | | | 2017 Summary Compensation Table | | |

| | DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE | | | Grants of Plan-Based Awards in 2017 | | |

| | Board of Directors | | | Agreement with Claude LeBlanc | | |

| | Board Leadership Structure | | | Agreements with Other Executive Officers | | |

| | Board Committees | | | Outstanding Equity Awards at 2017 Fiscal Year-End | | |

| | Board’s Role in Risk Oversight | | | Stock Vested in 2017 | | |

| | Director Independence | | | Nonqualified Deferred Compensation | | |

| | Compensation Committee Interlocks and Insider Participation | | | Potential Payments Upon Termination or Change-in-Control | | |

| | Consideration of Director Nominees | | | Pay Ratio Disclosure | | |

| | Executive Sessions | | | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | |

| | Outside Advisors | | | THE AUDIT COMMITTEE REPORT | | |

| | Board Effectiveness | | | SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | |

| | Code of Business Conduct | | | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | |

| | Board Compensation Arrangements for Non-Employee Directors | | | PROPOSAL NUMBER 1 | | |

| | COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | PROPOSAL NUMBER 2 | | |

| | EXECUTIVE COMPENSATION | | | PROPOSAL NUMBER 3 | | |

| | Executive Officers | | | Appendix A | | |

| | | | | | | |

|

|

Ambac Financial Group, Inc. |i | 2018 Proxy Statement |

PROXY STATEMENT SUMMARY

Below are the highlights of important information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before you vote. |

|

| Ambac Financial Group Fiscal Year 2017 Highlights |

New Leadership:

Claude LeBlanc was appointed as our new President and Chief Executive Officer and joined our Board of Directors effective January 1, 2017.

Performance Highlights:

The following events summarize our performance highlights for fiscal year 2017:

|

|

|

l Milestone achievement: laid the groundwork in 2017 for the successful exit from rehabilitation of Ambac Assurance Corporation’s (“AAC”) Segregated Account, which concluded in February 2018 |

l Decreased our insured portfolio by 21%, from $79.3 billion to $62.7 billion, and decreased Adversely Classified Credits by 17% from $17.0 billion down to $14.1 billion |

l Opportunistically purchased $815.2 million of Ambac-insured securities; we currently own 58% of AAC's insured COFINA bonds and 29% of AAC-insured PRIFA bonds |

l Reorganized operations and reduced costs - resulting in significant head count reduction and future annual compensation savings of approximately 20% |

l Strengthened public finance loss reserves, resulting in net loss of $(328.7) million, or $(7.25) per diluted share, and Adjusted Loss(1) of $(165.1) million, or $(3.64) per diluted share |

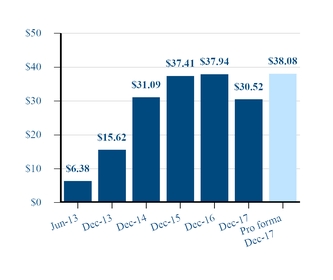

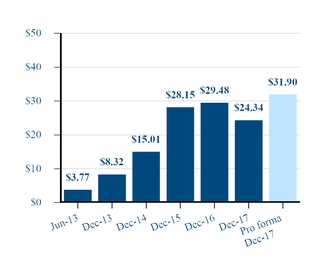

l Ended 2017 with total Ambac stockholders’ equity (“Book Value“) of $1.4 billion, or $30.52 per share, a decrease from $1.7 billion or $7.94 per share at December 31, 2016, and Adjusted Book Value(1) of $1.1 billion, or $24.34 per share, a decrease from $1.3 billion or $29.48 per share at December 31, 2016 |

l Accrued $30.5 million of tolling payments resulting from the utilization of Net Operating Losses (“NOLs”) at AAC, which will be paid to Ambac Financial Group, Inc. ("AFG") in May 2018, bringing AFG's assets to over $400 million |

|

| |

(1) | Adjusted Earnings (Loss) and Adjusted Book Value are non-GAAP measures. A reconciliation of these non-GAAP financial measures and the most directly comparable GAAP financial measure is presented in Appendix A. In this Proxy Statement, we refer to Total Ambac Financial Group, Inc. Stockholders' Equity as "Book Value." |

|

|

Ambac Financial Group, Inc. |1 | 2018 Proxy Statement |

Early in 2018 we successfully executed a transformational restructuring transaction for the Company, the conclusion of the rehabilitation of AAC’s Segregated Account. The impact of this transaction (which will be reflected in our first quarter 2018 financial results) includes:

|

|

|

l Creation of material value for our shareholders |

t Estimated increase in pro-forma Book Value of approximately $7.56 per share, or a 25% increase over our fourth quarter 2017 Book Value per share |

l Greater financial and strategic flexibility |

l A financially stronger AAC, making full payment on all future policy claims |

l Material reduction in ongoing rehabilitation and restructuring costs and other related expenses |

|

Performance Against Compensation Metrics

|

| | |

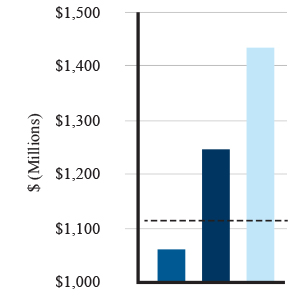

Book Value Per Share (1) | | Adjusted Book Value Per Share (1) (2) |

____________________________

| |

(1) | The Pro Forma as presented is after giving effect to the Rehabilitation Exit Transactions and Tier 2 Note issuance as further described in Note 1. Background and Business Description and Note 17. Subsequent Events of the Consolidated Financial Statements in Part II, Item 8 of Ambac's 2017 Annual Report on Form 10-K as if they occurred on December 31, 2017 rather than February 12, 2018. |

| |

(2) | Adjusted Book Value is a non-GAAP measure. A reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure is presented in Appendix A. |

|

|

Ambac Financial Group, Inc. |2 | 2018 Proxy Statement |

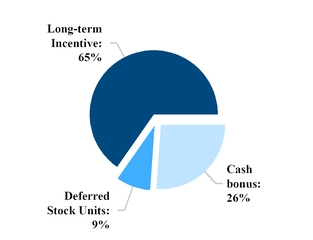

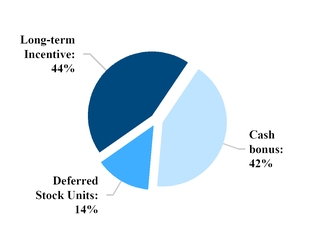

Performance Against Short Term Incentive Plan Metrics. For the 2017 fiscal year, we established the following goals for each of our Short Term Incentive Plan ("STIP") performance metrics and assigned a weighting factor as follows:

|

| | | | |

| ($ in millions) | Weighting Factor | Threshold | Target | Maximum |

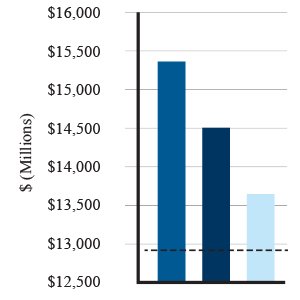

Adversely Classified Credits (1) | 30% | $15,336 | $14,487 | $13,632 |

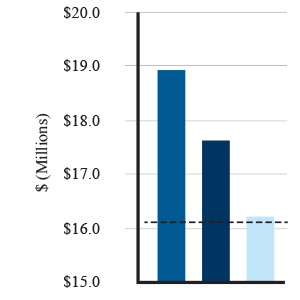

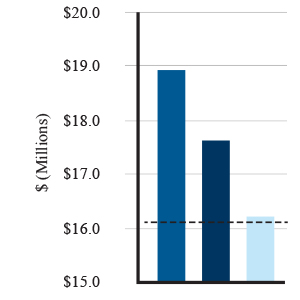

Gross Operating Run Rate Expenses (2) | 15% | $18.9 | $17.6 | $16.2 |

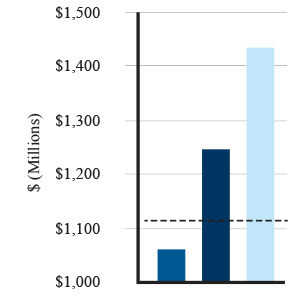

Adjusted Book Value (3) | 15% | $1,058 | $1,245 | $1,432 |

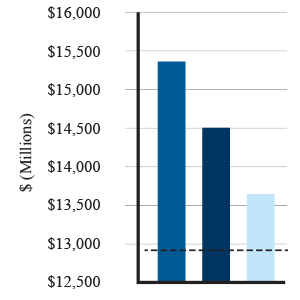

The following graph/charts shows the Company's 2017 actual performance compared to the threshold, target and maximum achievement levels as established for each of the performance metrics.

|

| | | | |

Adversely Classified Credit Net Par (1) | | Gross Operating Run Rate Expenses (2) | |

Adjusted Book Value (3) |

|

| | | | | | | |

| Minimum | | Target | | Maximum | - - - - - - | Actual |

____________________

| |

(1) | Reductions in adversely classified credits as of December 31, 2017 under the STIP were measured against adversely classified credits identified as of January 1, 2017. |

| |

(2) | Gross Operating Run Rate Expenses is measured by comparing actual gross operating run rate expenses for the fourth quarter of a fiscal year to performance goals established against budgeted amounts. |

| |

(3) | Adjusted Book Value is a non-GAAP measure. At the time the Compensation Committee approved Adjusted Book Value as an STIP Metric, its definition was consistent with definition of the non-GAAP measure included in Ambac's public disclosures. In response to a comment letter received from the Division of Corporation Finance of the Securities and Exchange Commission, Ambac revised its definition of Adjusted Book Value to no longer eliminate the effects of VIEs in the calculation of Adjusted Book Value. For purposes of the STIP, the Compensation Committee retained the previous definition of Adjusted Book Value. Additionally, Adjusted Book Value at December 31, 2017 does not incorporate the Rehabilitation Exit Transactions and Tier 2 Note issuance since they were recorded in Ambac's financial statements in 2018. A reconciliation of Adjusted Book Value and the most directly comparable GAAP financial measure is presented in Appendix A. |

With respect to the reductions in Adversely Classified Credits and reductions in gross operating run rate expenses for the fourth quarter of 2017, Ambac Respondsexceeded the maximum performance goal set for each of these metrics. Adversely Classified Credits were reduced to Canyon Capital's Accusations$12.9 billion net par outstanding, and gross operating run rate expenses for the fourth quarter of 2017 were reduced to $16.1 million. Adjusted Book Value at year-end was below target at $1,117 million.

NEW YORK, NY,

|

|

Ambac Financial Group, Inc. |3 | 2018 Proxy Statement |

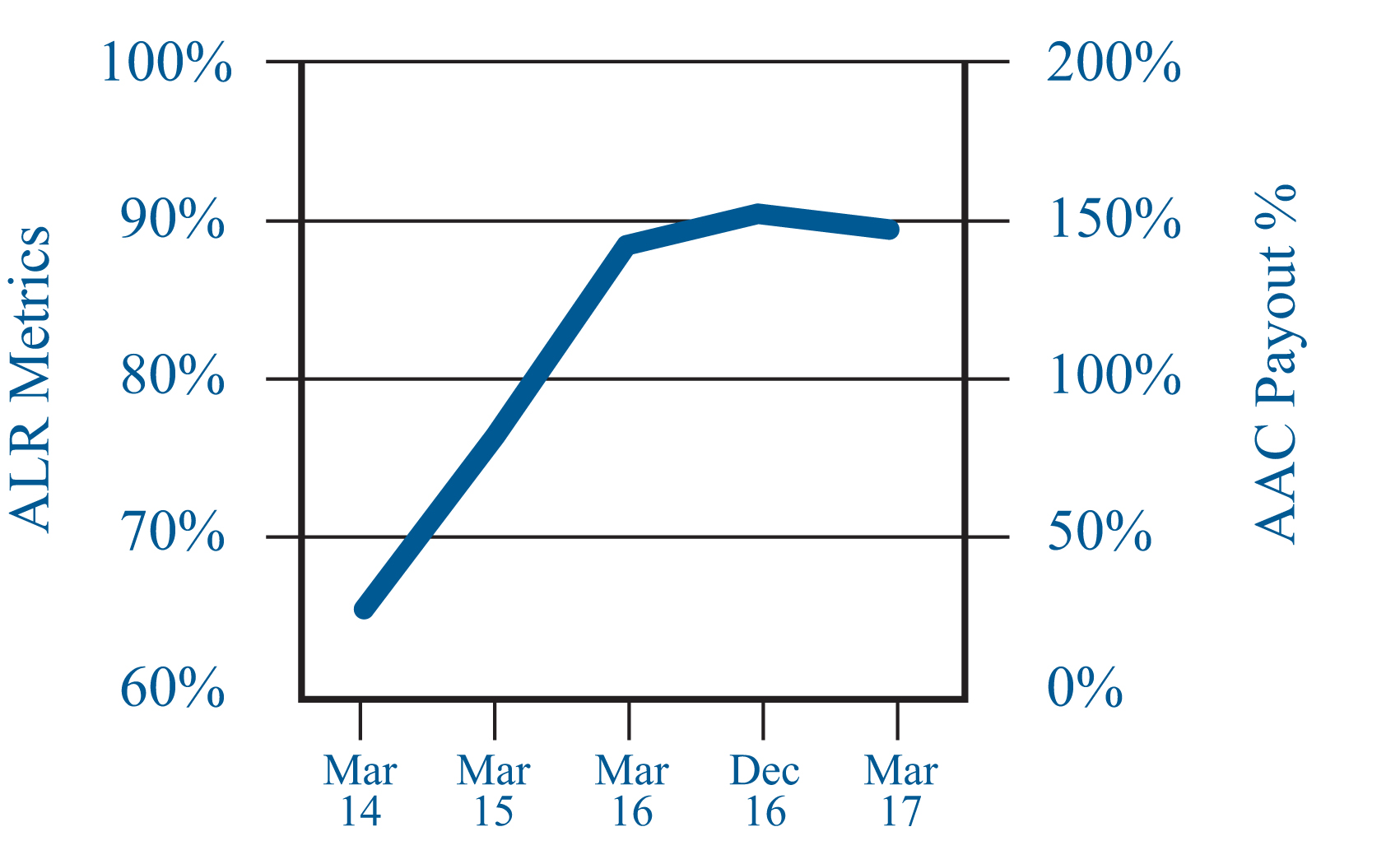

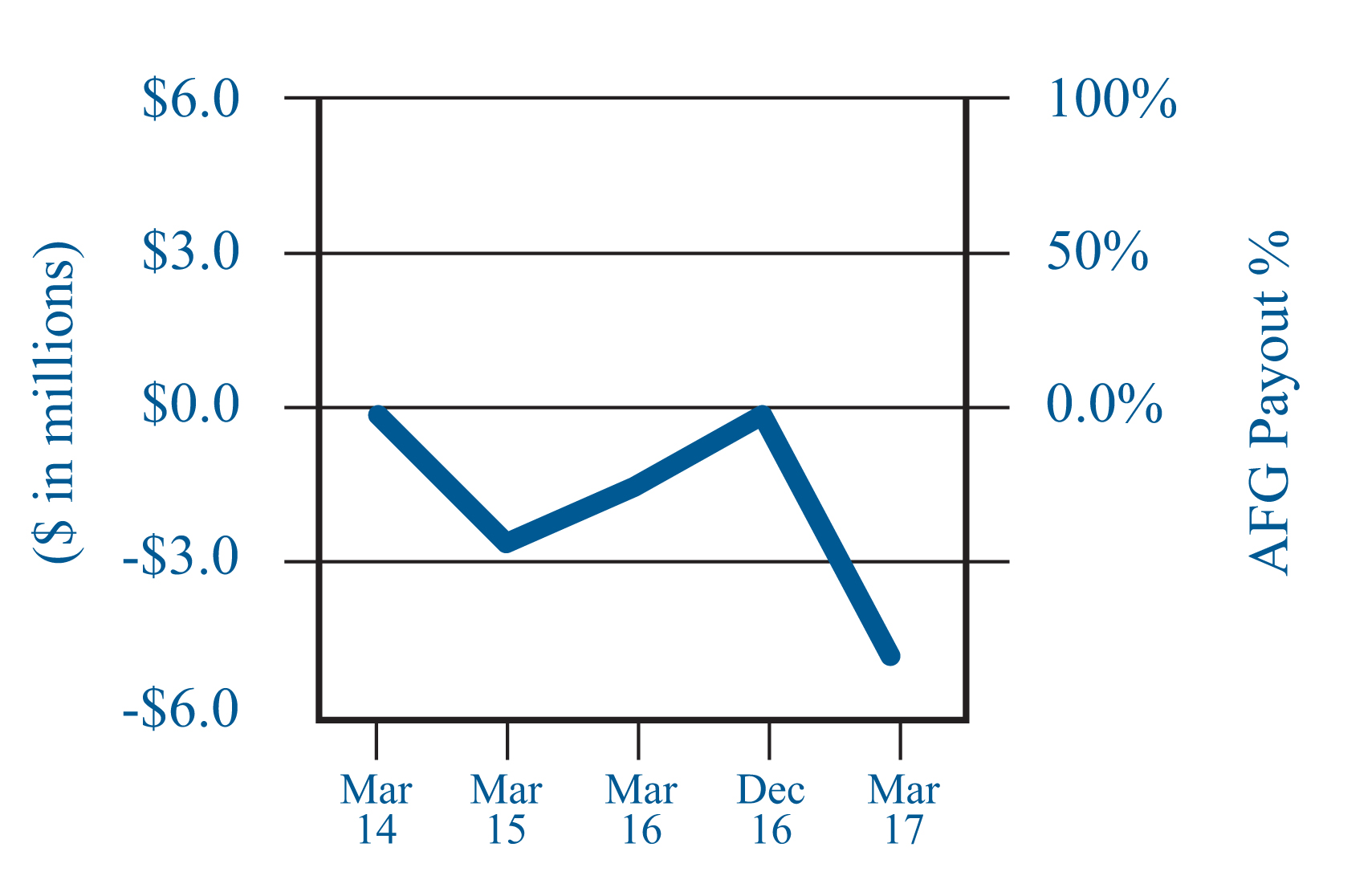

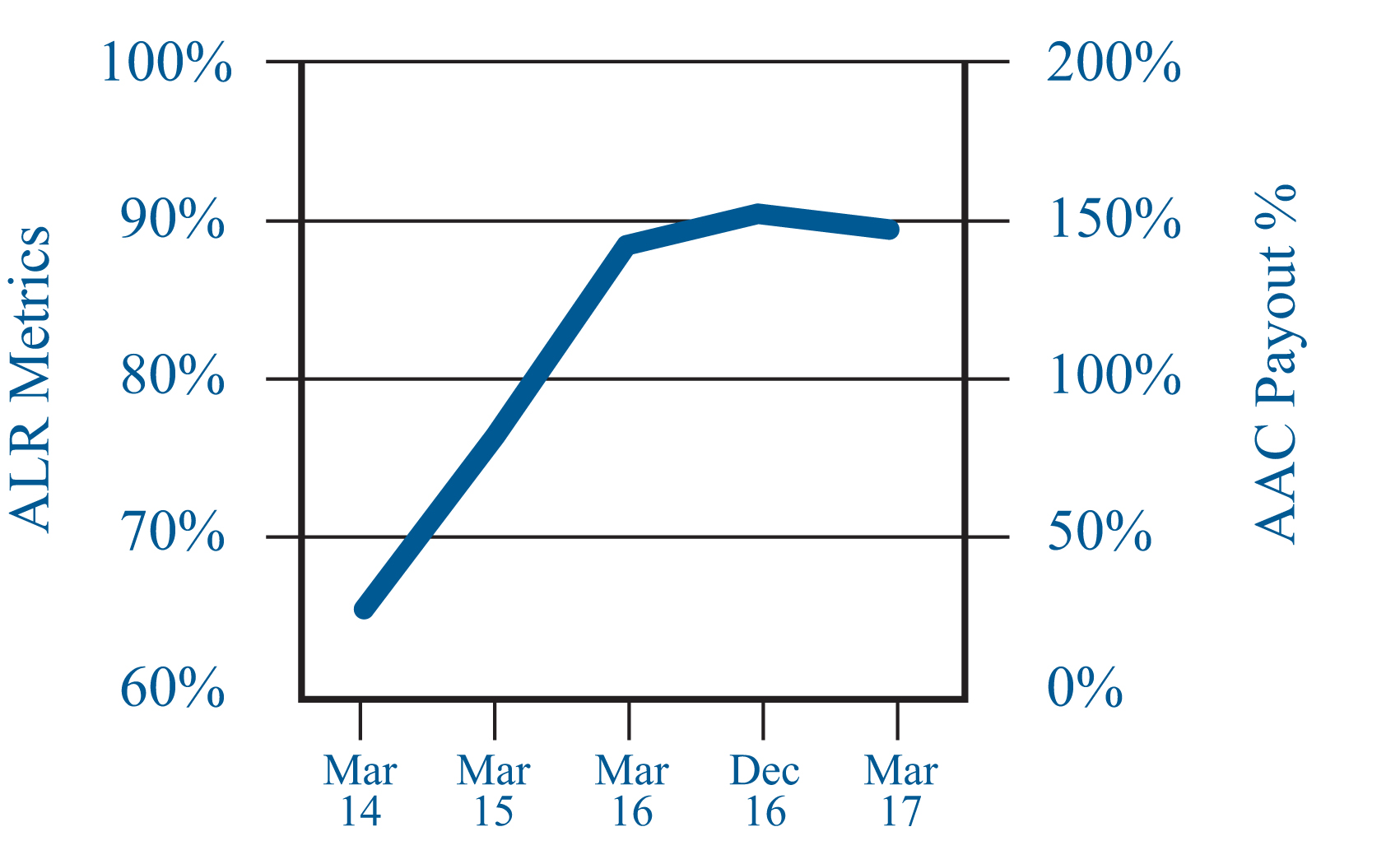

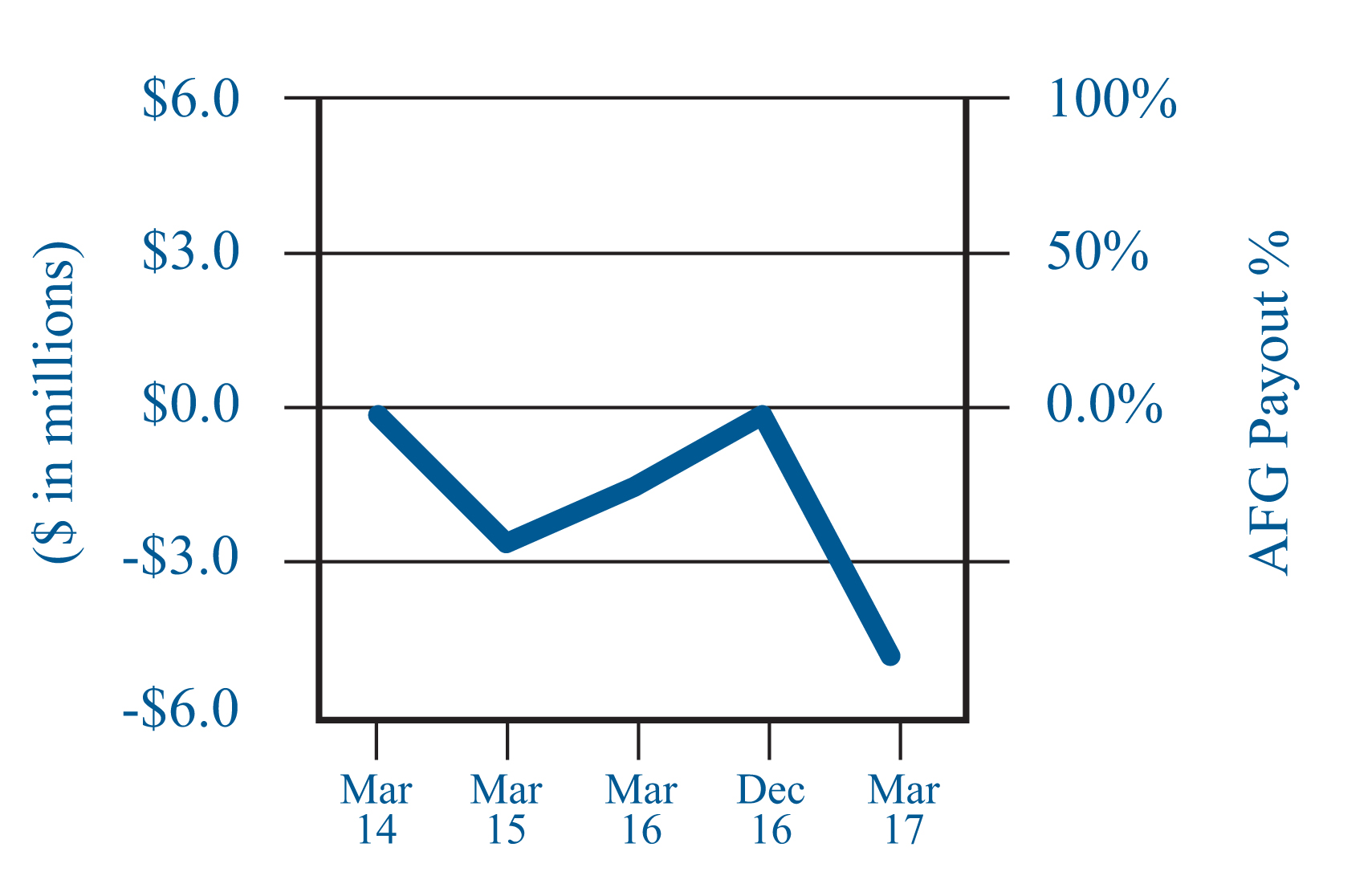

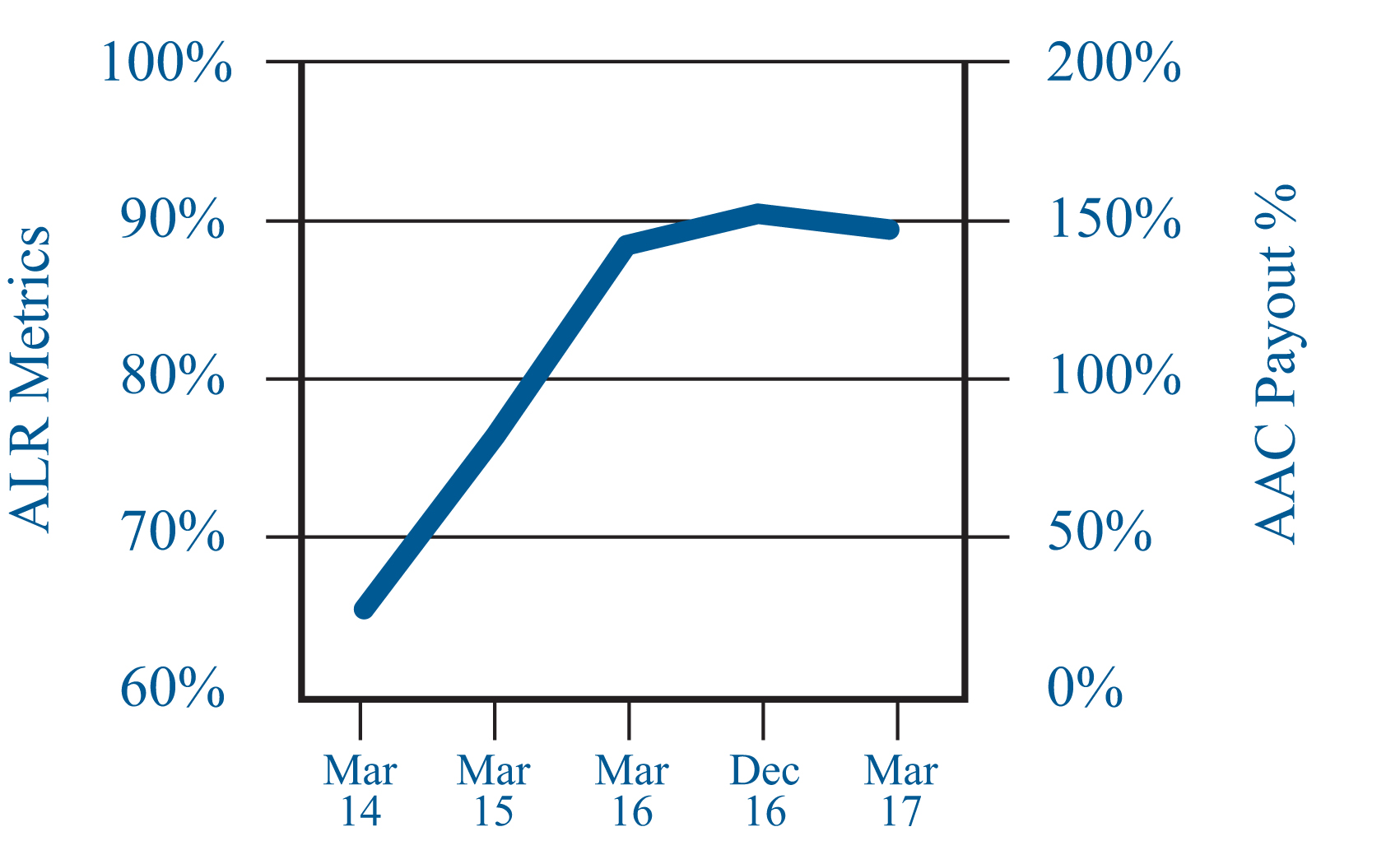

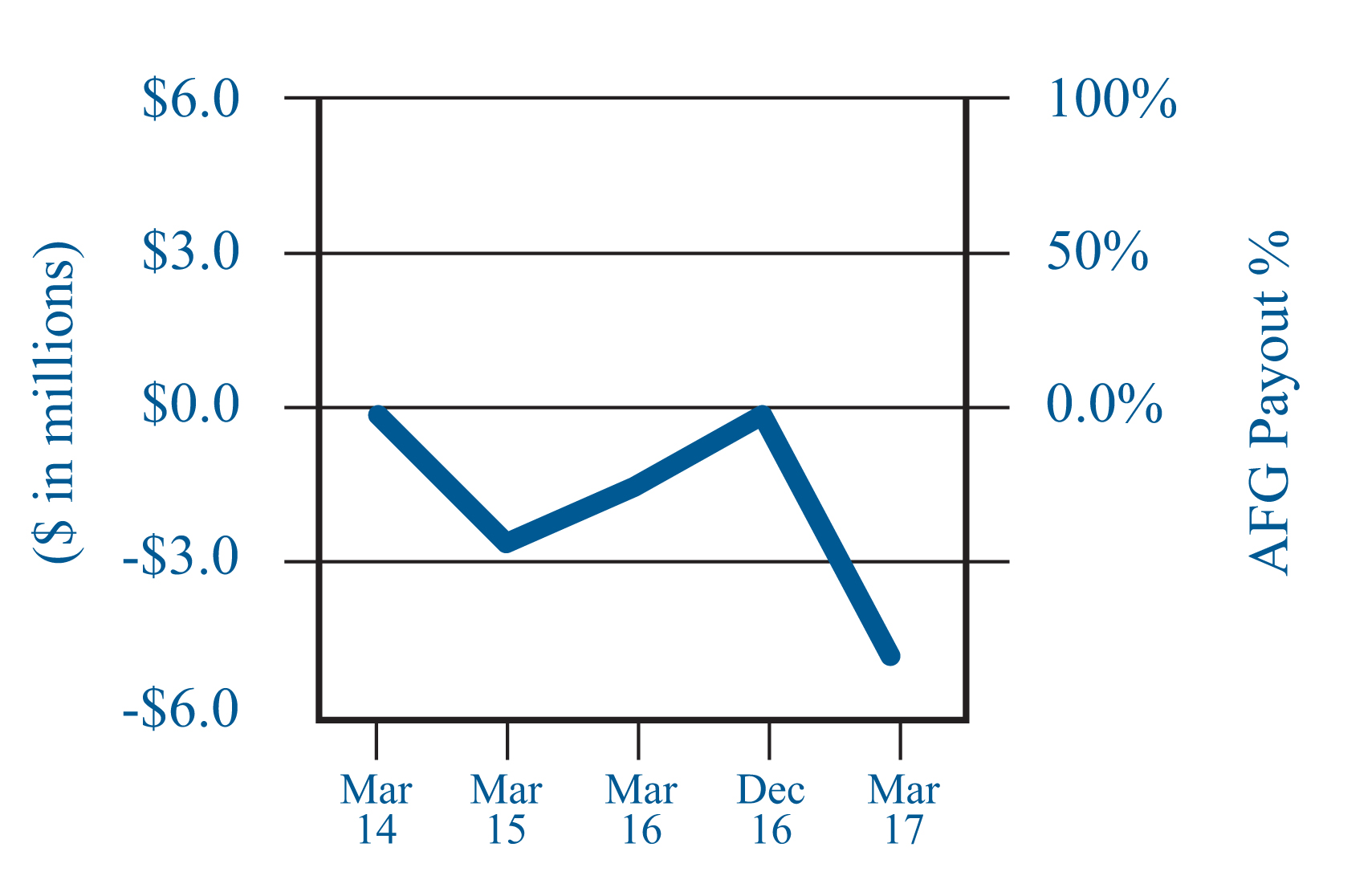

Performance against 2014 LTIP metrics. In 2014, we established the following three year goals for each of our LTIP performance metrics and assigned weighting factors based on each NEOs areas of responsibility.

|

| | |

Asset to Liability Ratio at AAC1 | Percentage of Target Award Earned | Cumulative EBITDA at Ambac1 ($ in millions) |

| 100% | 200% | $19 |

| 95% | 175% | $16 |

| 90% | 150% | $13 |

| 85% | 125% | $9 |

| 80% | 100% | $6 |

| 75% | 50% | $3 |

| 70% | 0% | $0 |

| |

(1) | Linear interpolation between levels results in a proportionate amount of the Ambac LTIP Target Award becoming earned and vested. |

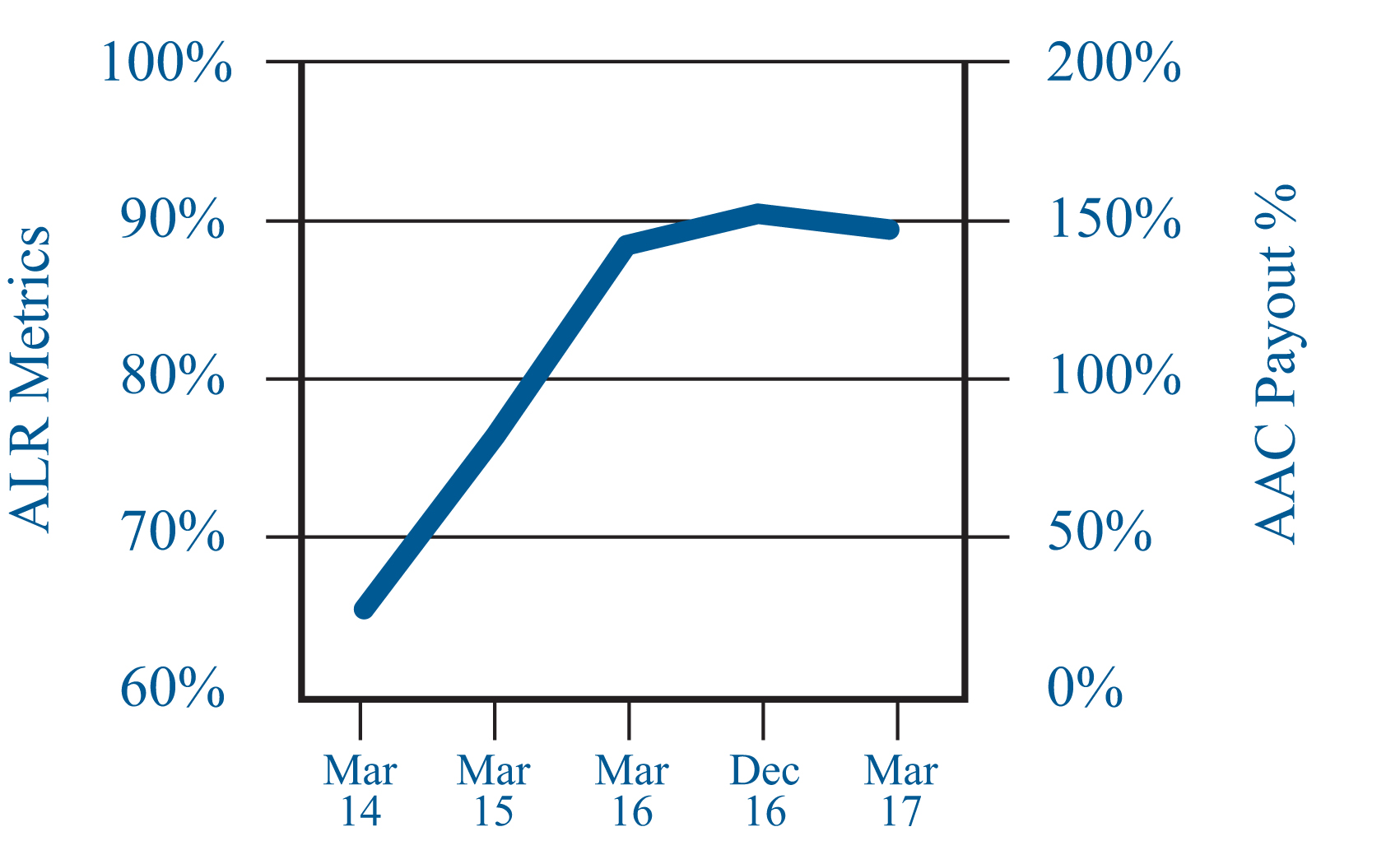

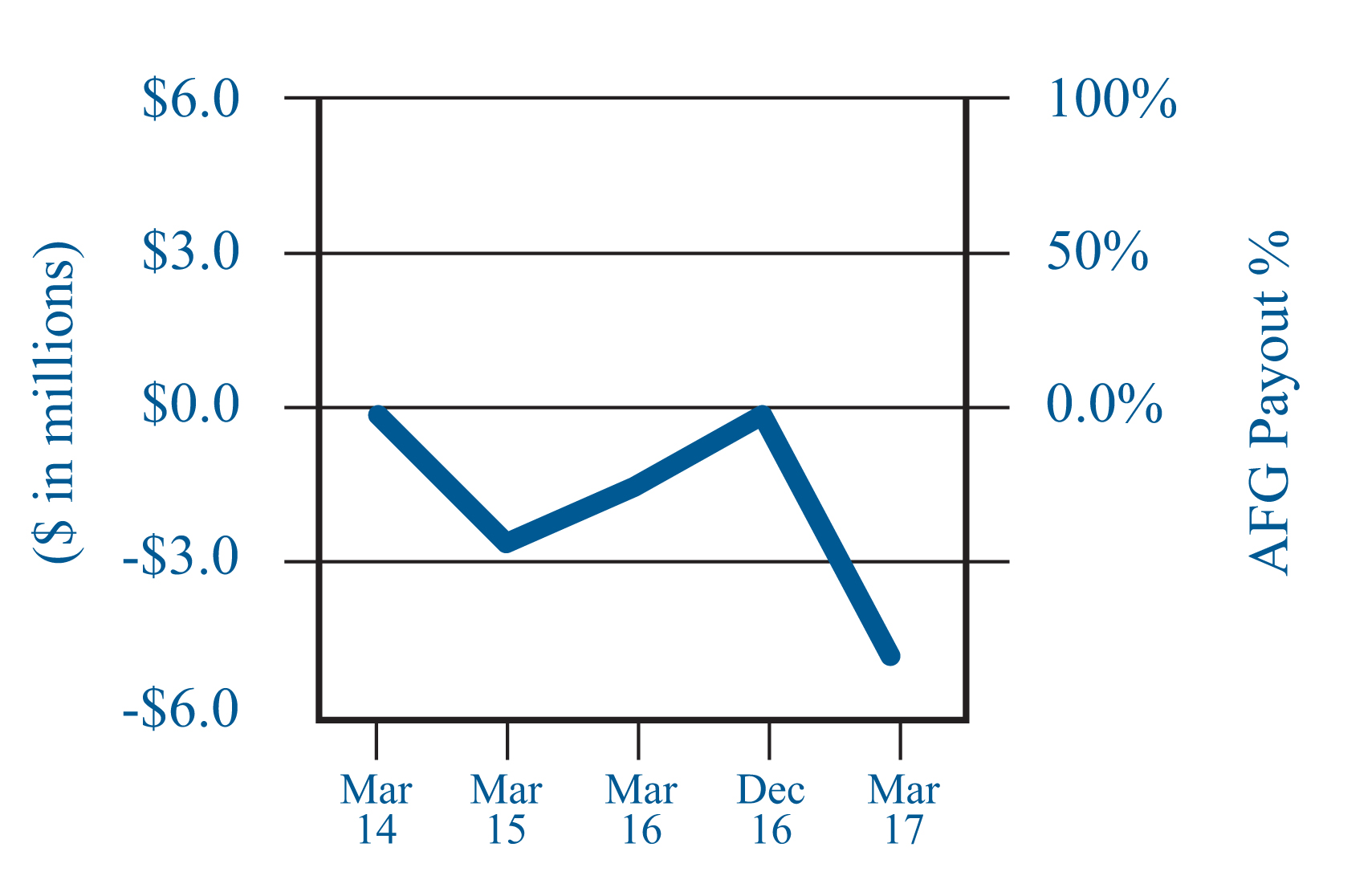

The following graph/charts shows the Company's actual performance over the three year performance period running from April 1, 2014 through March 9,31, 2017, compared to the achievement levels set forth in the chart above.

|

| | |

| AAC - Asset to Liability Ratio | | AFG - Cumulative EBITDA |

|

| | | | | |

| Change to ALR over the three year performance period | | | | Cumulative EBITDA over three year performance period |

| | | |

| | | |

With respect to improvements in the Asset to Liability Ratio at AAC, management exceeded the target performance goal and achieved an Asset to Liability Ratio equal to approximately 90%. With respect to Cumulative EBITDA at Ambac, the Company did not achieve the threshold level of performance.

|

|

Ambac Financial Group, Inc. |4 | 2018 Proxy Statement |

Corporate Governance:

We are committed to a corporate governance approach that positions the Company to achieve beneficial results for our stockholders. In pursuit of this approach, in 2017 the Chairman of the Board and the Chief Executive Officer, along with the Chairs of the Compensation Committee and the Governance and Nominating Committee solicited feedback from our stockholders representing just over 50% of our outstanding common stock. The discussions involved, among other things, the event driven nature of our business and corporate governance matters. Following these discussions, and after careful deliberation, the Governance and Nominating Committee and the Compensation Committee implemented the following policies in 2017 and 2018:

|

|

|

l We shifted our Short-Term Incentive Compensation Plan for our executive officers to be more performance-based by establishing financial performance metrics for calculating annual bonus payouts. Sixty percent of an executive officer's annual bonus for fiscal year 2017 was calculated based on the achievement of pre-established objective financial performance targets related to (i) Adjusted Book Value, (ii) reductions in gross operating run rate expense*, and (iii) reductions in adversely classified credits*. |

l We made reductions to our adversely classified credits an additional performance-based financial metric in our Long-Term Incentive Compensation Plan. |

l We adopted a recoupment policy (otherwise known as a claw-back policy) providing that in the event of a material financial restatement or the imposition of a material financial penalty, the Company may recoup incentive-based compensation received by our executive officers during a three-year look-back period. |

l We adopted an Executive Stock Ownership and Retention Policy (“Stock Ownership Policy”) applicable to all of our executive officers. |

l In 2018 we eliminated the "retesting" feature in the Long-Term Incentive Compensation Program that allowed performance at AAC to be measured by the greater of two metrics: an improved asset liability ratio ("ALR") or improved net asset value ("NAV") over a three year performance period. Beginning in 2018, metrics for LTIP awards related to AAC performance will be evaluated based on (i) reductions in "watch list" and adversely classified credits weighted at 42.5%, and (ii) improvements in NAV weighted at 42.5%. Ambac performance will continue to be evaluated based on cumulative EBITDA and weighted at 15%. Watch list credits represent exposures for which there may be heightened potential for future adverse development based on qualitative and quantitative stress assumptions. |

l We reduced the aggregate value of non-employee director annual cash retainer and equity grants for 2017 by 33% compared to 2016, which had the effect of increasing the equity component as a percentage of total compensation. |

|

| |

| * | Reductions in gross operating run rate expenseis measured by comparing actual gross operating run rate expenses for the fourth quarter of a fiscal year to performance goals established against budgeted amounts. Reductions in adversely classified credits as of December 31, 2017 under the STIP were measured against adversely classified credits as of January 1, 2017. |

|

|

Ambac Financial Group, Inc. |5 | 2018 Proxy Statement |

|

| |

| Corporate Governance Practices |

| |

| Ambac's corporate governance practices drive accountability to shareholders |

Independent Oversight and Leadership | ü 6 out of 7 directors independent ü Limited additional current Board obligations (no director sits on more than 3 other public company boards), allowing for focus on the execution of Ambac's strategy ü Separate Chairman and CEO roles ü Average tenure of <2 years (vs. S&P average of 8.4), enabling fresh perspective ü Added five new independent directors in the last four years with a focus on core skills and experience, as well as diversity and inclusion |

| |

Emphasis on Shareholder Rights | üNo classified board - all directors elected annually üShareholders can act by written consent and call special meetings üNo shareholder rights plan |

| |

Shareholder Engagement | üActively engaged with shareholders on corporate governance üTrack record of proactive, ongoing shareholder dialogue |

| |

Response to 2017 Say on Pay Vote and Stockholder Outreach

At our 2017 annual meeting, stockholders representing approximately 63% of our common stock present, in person or by proxy, at the meeting voted to approve, on an advisory basis, the compensation of our named executive officers described in our 2017 proxy statement. Following the 2017 say-on-pay vote, the Chairman of the Board, along with the Chairs of the Compensation Committee and the Governance and Nominating Committee solicited feedback from our stockholders representing just over 50% of our outstanding common stock and from certain proxy advisory firms. While the feedback on our executive compensation program was generally favorable, a number of stockholders expressed the view that the severance payments made in 2016 (GLOBE NEWSWIRE) --to our former Chief Executive Officer were in excess of what they considered acceptable. The full Board and the Compensation Committee will give this feedback appropriate consideration with respect to any future decisions on severance arrangements.

In addition, stockholders expressed the view that the method of measuring performance at AAC under the Company's Long Term Incentive Plan ("LTIP"), which was the "greater of an improved asset to liability ratio or an improved net asset value," allowed the Company alternative ways to satisfy performance and was deemed a "re-testing" feature. In response, beginning with the 2018 LTIP awards, the full Board and the Compensation Committee agreed to eliminate this "greater of" or "retesting" feature, and determined that the metrics for LTIP awards related to AAC performance would be evaluated based on (i) reductions in "watch list" and adversely classified credits, weighted at 42.5% and (ii) improvements in NAV, also weighted at 42.5%.

|

|

Ambac Financial Group, Inc. |6 | 2018 Proxy Statement |

Changes to the Executive Compensation Program

Over the past two compensation cycles, the Compensation Committee made a number of significant changes to the executives' compensation program, including: |

| | |

| Actions |

| Aligned Compensation to Market Levels | l Adopted a new compensation program for our Chief Executive Officer that is responsive to feedback received from stockholders and certain proxy advisory firms. The Chief Executive Officer’s total compensation is benchmarked at what the Compensation Committee believes is an appropriate level of compensation compared to peers. |

| | |

| Refocused Performance Metrics | l Established more rigorous performance goals based on multiple metrics for our short-term incentive program and structured the incentive compensation program for our Chief Executive Officer to align with the incentive compensation program for all of our executive officers. |

| Sixty percent of our Chief Executive Officer's annual bonus will be based on the achievement of pre-established objective financial performance metrics that have been established by the Compensation Committee pursuant to our Short-Term Incentive Compensation Plan and the remainder of the annual bonus opportunity will be based on discretionary non-financial goals and objectives. |

| The determination of the discretionary bonus is based on a number of factors, including but not limited to, evaluation of business unit performance and individual performance. The Compensation Committee believes that it is important to retain a substantial level of discretion with respect to non-financial considerations given the Company's continuing sensitivity to certain macro-economic events that are outside the control of management and could have a substantial negative impact on our insured exposures and financial performance.

|

| | |

| Amended the Short Term Incentive Compensation Plan to include an equity component | l 25% of the annual bonuses for executive officers are paid in deferred share units (“DSUs”) of Ambac. These DSUs will vest immediately, but settlement and conversion into Ambac common stock will take place over a two year period. |

| This change, along with the recently adopted Stock Ownership Policy, is expected to increase the level of equity ownership among the Company’s senior management. |

| |

| Amended the Long Term Incentive Compensation Plan to include a restricted stock unit component | l In order to encourage the retention of our most valued employees and to more closely align their interests with that of our stockholders, beginning in 2018, we included time based restricted stock units ("RSUs") as a component of our LTIP awards, with 66.6% of the award denominated in performance stock units and 33.3% in RSUs. |

|

| |

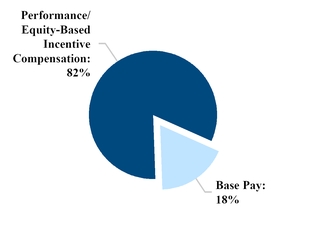

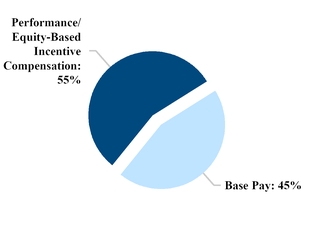

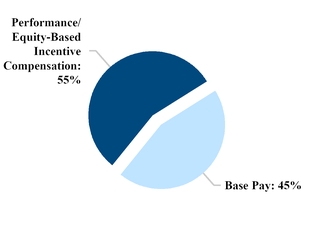

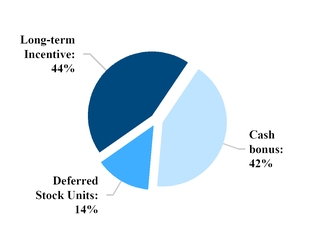

Overall, our current executive compensation program heavily emphasizes performance and equity-based compensation to more closely align management's incentives with stockholder interests, and includes other practices that we believe serve stockholder interests such as not providing tax “gross-up” payments, providing limited perquisites, adopting plan provisions relating to claw-backs of incentive awards and maintaining policies prohibiting the hedging or pledging our Company’s stock.

|

|

Ambac Financial Group, Inc. |7 | 2018 Proxy Statement |

AMBAC FINANCIAL GROUP, INC.

One State Street Plaza

New York, New York 10004

PROXY STATEMENT

GENERAL INFORMATION

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Proxy Materials

Why did I receive these Proxy Materials?

The Board of Directors of Ambac Financial Group, Inc. (Nasdaq: AMBC) ("Ambac" or the "Company") has made these materials available to you on the internet or, upon your request, has delivered printed proxy materials to you, in connection with the solicitation of proxies for use at Ambac’s 2018 Annual Meeting of Stockholders (the "Annual Meeting"), which will take place on May 18, 2018 at 11:00 a.m. (Eastern). The meeting will be held at our executive offices at One State Street Plaza, New York, New York 10004. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this Proxy Statement. This Proxy Statement includes information that we are required to provide to you under SEC rules and that is designed to assist you in voting your shares.

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the SEC, we may furnish proxy materials, including this Proxy Statement and our 2017 Annual Report to Stockholders, to our stockholders by providing access to such documents on the internet instead of mailing printed copies. Stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Internet Notice, which was mailed to our stockholders, will instruct you as to how you may access and review all of the proxy materials on the internet. The Internet Notice also instructs you as to how you may submit your proxy on the internet, by phone or by mail. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Internet Notice.

What is included in the proxy materials?

The proxy materials (collectively, “Proxy Materials”) include:

Our Proxy Statement for the 2018 Annual Meeting of Stockholders;

Our 2017 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2017; and

The proxy card or a voting instruction card for the Annual Meeting.

|

|

Ambac Financial Group, Inc. |8 | 2018 Proxy Statement |

How can I access the proxy materials over the internet?

The Internet Notice, proxy card or voting instruction card will contain instructions on how to:

View our proxy materials for the Annual Meeting on the internet and vote your shares; and

Instruct us to send our future proxy materials to you electronically by email.

Our proxy materials are available at www.proxyvote.com.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact on the environment of printing and mailing these materials. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

What information is contained in this Proxy Statement?

The information in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting and details regarding the voting process, the compensation of our directors and certain of our executive officers, corporate governance, and certain other required information.

Why did I only receive one set of materials when there is more than one stockholder at my address?

If two or more stockholders share one address, each such stockholder may not receive a separate copy of our Proxy Materials or Internet Notice. Stockholders who do not receive a separate copy of our Proxy Materials or Internet Notice and want to receive a separate copy may request to receive a separate copy of, or additional copies of, our Proxy Materials or Internet Notice via the internet, phone or email, as outlined above. Upon such request we shall furnish such copy, or additional copies, promptly. Stockholders who share an address and receive multiple copies of our Proxy Materials or Internet Notice may also request to receive a single copy by writing to our Investor Relations Department, Ambac Financial Group, Inc., One State Street Plaza, New York, New York 10004.

Voting Information

What items of business will be voted on at the Annual Meeting?

The items of business scheduled to be voted on at the Annual Meeting are:

The election of seven directors to our Board of Directors.

To approve, on an advisory basis, the compensation of our named executive officers.

The ratification of the appointment of KPMG LLP as Ambac’s independent registered public accounting firm for the fiscal year ending December 31, 2018.

We will also consider any other business that properly comes before the Annual Meeting.

How does the Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote your shares:

| |

| ü | "FOR” each of its nominees to the Board of Directors. |

| |

| ü | "FOR” the approval, on an advisory basis, of the compensation of our named executive officers. |

| |

| ü | "FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the 2018 fiscal year. |

|

|

Ambac Financial Group, Inc. |9 | 2018 Proxy Statement |

Other than the three items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Stephen M. Ksenak and William J. White, or either of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

What shares can I vote?

Each share of Ambac common stock issued and outstanding as of the close of business on the Record Date for the 2018 Annual Meeting of Stockholders is entitled to be voted with respect to all items on which stockholders may vote at the Annual Meeting. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record, and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee. On the Record Date, we had 45,332,214shares of common stock issued and outstanding.

How many votes am I entitled to per share?

Each holder of shares of common stock is entitled to one vote for each share of common stock held as of the Record Date. The voting rights of certain substantial holders of common stock are restricted. A holder (including any group consisting of such holder and any other person with whom such holder or any affiliate or associate of such holder has any agreement, contract, arrangement or understanding with respect to acquiring, voting, holding or disposing of our common stock) will be entitled to vote only such number of shares that would equal (after giving effect to this restriction) one vote less than 10% of the votes entitled to be cast by all holders of our outstanding common stock. This restriction does not apply if the acquisition or ownership of common stock has been approved, whether before or after such acquisition or first time of ownership, by the Wisconsin Insurance Commissioner. Our certificate of incorporation also restricts the right of certain transferees to vote certain of their shares to the extent that, as a result of a transfer of shares (or any series of transfers of which such transfer is a part), either (i) any person or group of persons shall become a five-percent stockholder or (ii) the percentage stock ownership interest in our shares of any five-percent stockholder (including a group of persons treated as a five-percent stockholder) shall be increased.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most Ambac stockholders hold their shares as a beneficial owner through a broker or other nominee rather than directly in their own name. If your shares are registered directly in your name with our transfer agent, Computershare Inc., you are considered, with respect to those shares, the stockholder of record. If your shares are held in an account at a brokerage firm, bank, broker-dealer, trust, or other similar organization, like the vast majority of our stockholders, you are considered the beneficial owner of shares held in street name.

How can I vote my shares at the Annual Meeting?

Shares held in your name as the stockholder of record or held beneficially in street name may be voted by you in person at the Annual Meeting or by proxy. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are indicated, the shares will be voted as recommended by the Board of Directors.

|

|

Ambac Financial Group, Inc. |10 | 2018 Proxy Statement |

How can I vote my shares without attending the Annual Meeting?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. You can vote by proxy over the internet or by phone by following the instructions provided in the Internet Notice, or, if you requested to receive printed proxy materials, you can also vote by mail pursuant to instructions provided on the proxy card. If you hold shares through a bank or broker, please refer to your proxy card or other information forwarded by your bank or broker to see which voting options are available to you.

You may submit your proxy by using the internet. The address of the website for submitting your proxy via the Internet is www.proxyvote.com for both registered holders and beneficial owners of our common stock holding in street name. Internet proxy submission is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on May 17, 2018. Easy-to-follow instructions allow you to submit your proxy and confirm that your instructions have been properly recorded.

You may submit your proxy by calling. The phone number for submitting your proxy by phone is 1-800-690-6903. Submitting your proxy by phone is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on May 17, 2018.

You may submit your proxy by mail. As a result of implementing “Notice and Access,” you may request to receive printed copies of proxy materials by mail or electronically by email by following the instructions provided in the Internet Notice. You may submit your request in writing to our Corporate Secretary at Ambac Financial Group, Inc., One State Street Plaza, New York, New York 10004 (or you can send an email to corporatesecretary@ambac.com). Once you receive your proxy materials, simply mark your proxy card, date and sign it, and return it in the postage-paid envelope.

Can I change my vote or revoke my proxy?

You may change your vote at any time prior to the taking of the vote at the Annual Meeting. You may change your vote by (i) granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (until the applicable deadline for each method), (ii) providing a written notice of revocation to Ambac’s Corporate Secretary at Ambac Financial Group, Inc., One State Street Plaza, New York, New York 10004 (and you can send a copy via email to corporatesecretary@ambac.com), prior to your shares being voted, or (iii) attending the Annual Meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote in person at the Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed to parties other than Ambac, except:

As necessary to meet applicable legal requirements;

To allow for the tabulation and certification of votes; or

To facilitate a proxy solicitation.

How many shares must be present or represented to conduct business at the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the voting power of Ambac’s shares of common stock outstanding as of the Record Date will constitute a quorum. Both abstentions and broker non-votes (described below) are counted for the purpose of determining the presence of a quorum.

|

|

Ambac Financial Group, Inc. |11 | 2018 Proxy Statement |

How may I vote in the election of directors, and how many votes must the nominees receive to be elected?

With respect to the election of directors, you may:

vote “FOR” all seven nominees for director;

vote “FOR” some of the nominees; or

“WITHHOLD” from voting with respect to one or more of the nominees for director.

Our directors are elected by a plurality of the shares of common stock present or represented by proxy and entitled to vote on the election of directors. This means that the seven individuals nominated for election to the Board who receive the most “FOR” votes among votes properly cast will be elected. Only “FOR” or “WITHHELD” votes are counted in determining whether a plurality has been cast in favor of a director nominee. A “WITHHELD” vote is not considered a vote cast "FOR" or "AGAINST" a director nominee under a plurality vote standard. You cannot abstain in the election of directors and broker non-votes are not counted. Each holder of our common stock is entitled to one vote for each share held as of the Record Date. There are no cumulative voting rights associated with any of Ambac's common stock.

How may I vote for the non-binding advisory vote approving executive compensation, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

vote “FOR” the approval of the non-binding resolution regarding executive compensation;

vote “AGAINST” the approval of the non-binding resolution regarding executive compensation; or

"ABSTAIN” from voting on the proposal.

In accordance with applicable law, this vote is “advisory,” meaning it will serve as a recommendation to our Board of Directors, but will not be binding. However, our Board of Directors and the Compensation Committee thereof will consider the outcome of the vote when making future compensation decisions for our executive officers.

How may I vote for the proposal to ratify the appointment of our independent registered public accounting firm, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

vote “FOR” the ratification of the accounting firm;

vote “AGAINST” the ratification of the accounting firm; or

“ABSTAIN” from voting on the proposal.

In order to pass, the proposal must receive the affirmative vote of a majority of the votes entitled to be cast by holders of our common stock at the Annual Meeting by the holders who are present in person, or by proxy.

What are broker non-votes?

If you hold shares beneficially in street name and do not vote your shares as described in this Proxy Statement, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. All of the matters scheduled to be voted on at the Annual Meeting are “non-routine,” except for the proposal to ratify the appointment of KPMG LLP as Ambac’s

|

|

Ambac Financial Group, Inc. |12 | 2018 Proxy Statement |

independent registered public accounting firm for the fiscal year ending December 31, 2018. In tabulating the voting result for any “non-routine” proposal, shares that constitute broker non-votes are not considered voting power present with respect to that proposal. Thus, broker non-votes will not affect the outcome of any “non-routine” matter being voted on at the Annual Meeting, assuming that a quorum is obtained. Abstentions are considered voting power present at the meeting and thus will have the same effect as votes against each of the matters scheduled to be voted on at the Annual Meeting (other than the election of directors).

Brokers may not vote your shares on the election of directors, certain executive compensation matters, or certain corporate governance matters in the absence of your specific instructions as to how to vote, so we encourage you to provide instructions to your broker regarding the voting of your shares.

Who will bear the cost of soliciting votes for the Annual Meeting?

Ambac pays the entire cost of preparing, assembling, printing, mailing, and distributing the proxy materials and soliciting votes. If you choose to access the proxy materials and/or vote over the internet, you are responsible for internet access charges you may incur. If you choose to vote by phone, you are responsible for any phone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities.

What happens if additional matters are presented at the Annual Meeting?

Other than the three items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Stephen M. Ksenak or William J. White, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any reason, any of the nominees for director included in this Proxy Statement is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting and publish final voting results in the Annual Meeting of Stockholders section of our Investor Relations website at http://ir.ambac.com. We will also disclose the final voting results on a Current Report on Form 8-K filed with the SEC within four business days following the date on which the Annual Meeting concludes.

Attending the Annual Meeting

How can I attend the Annual Meeting?

Only stockholders, their proxy holders and our guests may attend the Annual Meeting. Verification of ownership will be requested at the admissions desk. If you are a holder of record and plan to attend the Annual Meeting, please indicate this when you vote. When you arrive at the Annual Meeting, you will be asked to present photo identification, such as a driver’s license. If your shares are held in the name of your broker, bank or other nominee, you must bring to the meeting an account statement or letter from the nominee indicating that you were the beneficial owner of the shares on March 20, 2018, the record date for voting. If you want to vote your common stock held in street name in person, you must get a written proxy in your name from the broker, bank or other nominee that holds your shares. If you wish to obtain directions to attend the meeting in person, you may send an email to: corporatesecretary@ambac.com or call (212) 658-7456.

Do directors attend the Annual Meeting?

It is currently expected that all of our directors will attend our Annual Meeting of Stockholders. All of our directors who were on the Board last year attended the 2017 Annual Meeting of Stockholders.

|

|

Ambac Financial Group, Inc. |13 | 2018 Proxy Statement |

How can I find out if I am a stockholder of record entitled to vote?

For a period of at least ten days before the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for inspection by stockholders of record during ordinary business hours at our principal executive offices at One State Street Plaza, New York, New York 10004.

Other Questions Related to the Meeting or Ambac

Who will serve as inspector of elections?

The inspectors of election will be representatives from Broadridge Financial Solutions, Inc.

How can I contact Ambac’s transfer agent?

Contact our transfer agent by either writing to Computershare Inc., PO Box 505000, Louisville, KY 40233, or 462 South 4th Street, Suite 1600, Louisville, KY 40202, by telephoning 1-800-662-7232 or via the web at www.computershare.com/investor.

Whom should I call if I have any questions?

If you have any questions about the Annual Meeting or voting, please contact William J. White, Corporate Secretary, at (212) 658-7456 or by email at corporatesecretary@ambac.com. If you have any questions about your investment in Ambac common stock, please contact Lisa Kampf, Managing Director, Investor Relations, at (212) 208-3177 or by email at ir@ambac.com.

How can a stockholder communicate directly with our Board?

Stockholders and other interested parties may communicate with Ambac’s Board by writing to Ambac’s Corporate Secretary at Ambac Financial Group, Inc., One State Street Plaza, New York, New York 10004 or by sending an email to Ambac’s Corporate Secretary at corporatesecretary@ambac.com. Ambac’s Corporate Secretary will then forward your questions or comments directly to the Board.

Please note that material that is directly or indirectly hostile or threatening, illegal or otherwise unsuitable will not be forwarded to our Board. Any communication that is relevant to Ambac’s business and is not forwarded will be retained for one year and will be made available to our independent directors on request. The independent directors grant the Corporate Secretary discretion to decide what correspondence shall be shared with Ambac management and specifically instruct that any personal employee complaints be forwarded to our Human Resources Department.

What is the deadline to propose actions for consideration at next year’s Annual Meeting of Stockholders or to nominate individuals to serve as directors?

For Stockholder Proposals that are to be included in our Proxy Statement under Rule 14a-8.Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (“Exchange Act”), if a stockholder wants Ambac to include a proposal in our proxy statement and form of proxy for presentation at our 2019 Annual Meeting of Stockholders (other than a proposal relating to the nomination of a specific individual for election to our Board of Directors), the proposal must be received by us at our principal executive offices at One State Street Plaza, New York, New York 10004, not later than December 7, 2018. The proposal must be sent to the attention of our Corporate Secretary, and must comply with the requirements of Regulation 14A under the Exchange Act (including, but not limited to, Rule 14a-8 or its successor provision).

|

|

Ambac Financial Group, Inc. |14 | 2018 Proxy Statement |

Other Proposals and Nominations. Our by-laws govern the submission of nominations for director or other business proposals that a stockholder wishes to have considered at a meeting of stockholders, but which are not included in our proxy statement for that meeting. Under our by-laws, nominations for director or other business proposals to be addressed at our next annual meeting may be made by a stockholder entitled to vote who has delivered a notice to the Corporate Secretary of Ambac Financial Group, Inc. no later than the close of business onMarch 20, 2019, and not earlier than February 18, 2019, except if the date of our next annual meeting is not within 30 days before or after the anniversary of our 2018 Annual Meeting of Stockholders, such notice must be delivered no earlier than the 90th day before our 2019 Annual Meeting of Stockholders and no later than the later of the 60th day before our 2019 Annual Meeting of Stockholders and the 15th day following the day on which public announcement of the date of our 2019 Annual Meeting of Stockholders is first made by the Company. The notice must set forth and describe the information required by Article II of our by-laws.

These advance notice and information requirements are in addition to, and separate from, the requirements that a stockholder must meet in order to have a proposal included in our proxy statement under the rules of the SEC. A proxy granted by a stockholder will give discretionary authority to the proxies to vote on any matters introduced pursuant to the above-referenced by-law provisions, subject to applicable rules of the SEC.

INCORPORATION BY REFERENCE

To the extent that this Proxy Statement has been or will be specifically incorporated by reference into any other filing of Ambac under the Securities Act of 1933, as amended, or the Exchange Act, the sections of this Proxy Statement titled “Report of the Audit Committee” (to the extent permitted by the rules of the SEC) shall not be deemed to be so incorporated, unless specifically provided otherwise in such filing.

|

|

Ambac Financial Group, Inc. |15 | 2018 Proxy Statement |

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Board of Directors

The Board oversees the business of Ambac and monitors the performance of management. Addressing issues following Ambac’s emergence from Chapter 11 and the challenges confronting our principal operating subsidiary, AAC, a financial guarantee insurance company, whoserequires a high level of focus, time commitment and engagement from our directors. The Board meets approximately five times per year in regularly scheduled meetings, but will meet more often, if necessary. The Board met fourteen times in 2017. Outside of formal meetings, directors frequently engage with management concerning Ambac’s business and strategies. In 2017, each director attended at least 95% of the total number of meetings of the Board and any committees on which he served.

All of our current directors also serve as directors of AAC.

Directors

The names of our directors and their ages, positions, and biographies are set forth below. There are no family relationships among any of our directors or executive officers.

|

| | | | | | | |

| | | | | Committee Membership |

| Name | Director Since | Age | Independent | Audit | Compensation | Governance and Nominating | Strategy and Risk Policy |

| Alexander D. Greene | 2015 | 59 | l | | l | q | l |

| Director | | | | | | | |

| Ian D. Haft | 2016 | 47 | l | l è | l | | q |

| Director | | | | | | | |

| David L. Herzog | 2016 | 58 | l | q è | | | l |

| Director | | | | | | | |

| Joan Lamm-Tennant | 2018 | 65 | l | l | | | l |

| Director | | | | | | | |

| Claude LeBlanc | 2017 | 52 | | | | | |

| President and Chief Executive Officer and Director | | | | | | | |

| C. James Prieur | 2016 | 66 | l | l è | q | l | |

| Director | | | | | | | |

| Jeffrey S. Stein | 2013 | 48 | l | | | l | |

| Chairman of the Board | | | | | | | |

q Chairman l Member è Audit Committee Financial Expert |

Alexander D. Greene

Mr. Greene has been a director since April 2, 2015. Mr. Greene has over 35 years of corporate finance and private equity experience. From December 2005 to March 2014, he was a Managing Partner and head of U.S. Private Equity at Brookfield Asset Management, a global asset management company. At Brookfield, he led a team that invested in companies where operational improvement and strategic guidance were primary drivers of value creation. Prior to joining Brookfield, Mr. Greene was a Managing Director and co-head of Carlyle Strategic Partners, a private equity fund investing in financially distressed industrial companies; and at Wasserstein Perella & Co., and Whitman Heffernan Rhein & Co., served as an investment banker to large and mid-cap companies, boards of directors and other constituencies, focusing on leveraged finance, merger and acquisition and recapitalization transactions. Mr. Greene is chairman of the board of Modular Space Corporation and a director of USA Truck, Inc. and FC Pioneer, and formerly served as a director of Longview Fibre Paper and Packaging, CWC Energy Services Corp., Civeo Corporation and Overseas Shipholding Group, Inc. He is president of the

|

|

Ambac Financial Group, Inc. |16 | 2018 Proxy Statement |

Armonk Independent Fire Department and serves on the Budget and Finance Advisory Committee for the Town of North Castle, New York. He holds a Bachelor of Business Administration in Finance from George Washington University.

Experience, Qualifications and Skills:

With over 30 years of corporate finance and private equity experience, Mr. Greene has substantial insight and understanding of the issues affecting Ambac. In particular, his service at Brookfield Asset Management, where he led a team that invested in companies where operational improvement and strategic guidance were primary drivers of value creation, is invaluable to Ambac. He has served as an adviser to boards of directors and other constituencies, focusing on leveraged finance, merger and acquisition and recapitalization transactions. This background, as well as his financial expertise and other board experience, makes Mr. Greene well qualified to serve on our Board of Directors, its Strategy and Risk Policy Committee and Compensation Committee, and to chair our Governance and Nominating Committee.

Ian D. Haft

Mr. Haft has been a director since March 28, 2016. He is the Managing Partner and CEO of Surgis Capital LLC (“Surgis’), an investment manager he founded in 2018. From 2009 until 2017, Mr. Haft was a founding partner and Vice President and Secretary of Cornwall Capital Management LP (“Cornwall”), an investment manager. At Cornwall, Mr. Haft previously held the positions of Chief Financial Officer (until November 2011) and Chief Operating Officer and Chief Compliance Officer (until the end of 2015). Mr. Haft was also a member of Cornwall GP, LLC, the general partner of Cornwall Master LP. Prior to joining Cornwall, Mr. Haft was a Principal at GenNx360 Capital Partners, a private equity fund, from 2008 to 2009. From 2002 to 2008, Mr. Haft was a Senior Associate and then Vice President (from 2004) at ACI Capital Co., LLC, where he focused on middle market leveraged buyouts and growth equity investments on behalf of two private equity funds. Mr. Haft began his career at The Boston Consulting Group in 1993 and was also employed by Merrill Lynch & Co. and The Blackstone Group prior to joining ACI Capital in 2002. Mr. Haft currently serves as Chairman of the Board of Hone Fitness Inc. (since March 2014) and also serves as member of the board of directors of several private companies. Mr. Haft previously served as a director of American Pacific Corporation (NASDAQ: APFC) from March 2013 until February 2014. Mr. Haft graduated magna cum laude with a BA in economics and mathematics from Dartmouth College in 1993 and he received his JD and MBA from Columbia University in 2000. Mr. Haft has extensive experience working with companies of all sizes and identifying, understanding and utilizing areas of value creation.

Experience, Qualifications and Skills:

Mr. Haft has over twenty years of experience working in alternative asset management, investment banking and management consulting. Through this experience, he has developed strong capabilities in business strategy, strategic analysis of industries and companies, mergers and acquisitions, valuation, debt and equity financing, derivatives and hedging, financial controls and regulatory compliance. Mr. Haft’s background and experience make him well-qualified to serve on our Board of Directors and to serve on its Audit Committee and Compensation Committee, and to chair the Strategy and Risk Policy Committee.

David L. Herzog

Mr. Herzog has been a director since March 28, 2016. He was the Chief Financial Officer and Executive Vice President of AIG from October 2008 until his retirement from AIG in April 2016. Mr. Herzog served as Senior Vice President and Comptroller of AIG from June 2005 to October 2008, Chief Financial Officer for worldwide life insurance operations from April 2004 to June 2005 and Vice President, Life Insurance from 2003 to 2004. In addition, Mr. Herzog has served in other senior officer positions for AIG and its subsidiaries, including as the Chief Financial Officer and Chief Operating Officer of American General Life following its acquisition by AIG. Previously, Mr. Herzog served in various executive positions at GenAmerica Corporation and Family Guardian Life, a Citicorp Company, and at a large accounting firm that is now part of PricewaterhouseCoopers LLP. Mr.

|

|

Ambac Financial Group, Inc. |17 | 2018 Proxy Statement |

Herzog currently serves as a member of the Board of Directors of MetLife, Inc., DXC.technology and PCCW Ltd. Mr. Herzog received a bachelor's degree in accounting from the University of Missouri-Columbia and a master of business administration in finance and economics from the University of Chicago. In addition, Mr. Herzog holds the designations of Certified Public Accountant and Fellow, Life Management Institute.

Experience, Qualifications and Skills:

Mr. Herzog was a key member of the AIG restructuring teams that orchestrated the repayment of US Government support provided following the 2008 financial crisis, and the repositioning of AIG’s debt capital structure. Mr. Herzog's financial and management experience in the oversight of AIG and its subsidiaries make him well qualified to serve on our Board of Directors and its Strategy and Risk Policy Committee and to chair the Audit Committee.

Joan Lamm-Tennant

Joan Lamm-Tennant has been a director since March 1, 2018. She is currently the Chief Executive Officer of Blue Marble Microinsurance, a corporation formed by a consortium of eight insurance entities for the purpose of developing service ventures enabling the insurers to enter the microinsurance market. Previously, Ms. Lamm-Tennant was the Global Chief Economist and Risk Strategist of Guy Carpenter & Company, LLC, the reinsurance and risk advisory operating company of Marsh & McLennan Companies. Prior to joining Guy Carpenter in 2007, Ms. Lamm-Tennant was the founding President of General Reinsurance Capital Consultants. She is currently an Adjunct Professor at the Wharton School, University of Pennsylvania and held the Laurence and Susan Hirsch Chair in International Business. She currently serves on the Board of Hamilton Insurance Group and Element Fleet Management Corp. as well as the International Insurance Society. Ms. Lamm-Tennant served on the Board of Selective Insurance Group from 1994 to 2015 and Ivans (an insurance technology provider) from 2001 to 2013. Ms. Lamm-Tennant holds a Ph.D. in Finance and Investments from the University of Texas, Austin; an M.B.A. in Finance from St. Mary's University, San Antonio, Texas and a B.B.A. with Honors in Accounting from St. Mary's University, San Antonio, Texas.

Experience, Qualifications and Skills:

Ms. Lamm-Tennant has over 20 years of finance, and risk management experience in the insurance industry. She served as a risk strategist for Marsh & McLennan and formalized the enterprise wide risk oversight function resulting in the appointment of a Chief Risk Officer and a dedicated Board Risk Committee. Her expertise in emerging market strategy, enterprise risk modeling, implementation of risk-based decision processes and high value strategies resulting in capital efficiencies and profitable growth make her well-qualified to serve on our Board of Directors and its Audit Committee and Strategy and Risk Policy Committee.

Claude LeBlanc

Mr. LeBlanc has served as President and Chief Executive Officer, and director of Ambac Financial Group, Inc. and Ambac Assurance Corporation (“AAC”)since January 1, 2017. Previously, Mr. LeBlanc was the Chief Financial Officer and Chief Restructuring Officer of Syncora Holdings Ltd., provideuntil December 24, 2016. In these roles, which he held since 2010, he actively led global remediation and asset recovery initiatives, evaluated strategic alternatives for Syncora and oversaw all aspects of the finance function. He also served as Special Advisor to Syncora’s Board of Directors beginning in 2008. As Special Advisor, he led the successful restructuring of Syncora during the 2008-2009 financial guaranteescrisis and again in its 2016 restructuring. Mr. LeBlanc joined Syncora in 2006 as Executive Vice President and was responsible for all corporate development activities, strategic development, capital planning, and management of key bank and rating agency relationships. Prior to joining Syncora, Mr. LeBlanc served as Senior Vice President of Corporate Development and Strategy and as a member of the executive management group for XL Capital Ltd. In this role, he led various global corporate development initiatives, oversaw and managed significant capital market transactions, and, reporting to the Chief Financial Officer and Chief of Staff, was responsible for global strategy development and capital management. Prior to joining XL Capital in 2002, he served as Chief Operating Officer and a member of the executive management team for Transworld Network International, a North American telecommunications group where he led corporate

|

|

Ambac Financial Group, Inc. |18 | 2018 Proxy Statement |

development, financial planning, and certain business operations. Mr. LeBlanc began his career in 1991 at PricewaterhouseCoopers and later served as Vice President of Financial Advisory Services in 1997 when he advised on mergers and acquisitions, corporate restructurings, and transaction advisory. Mr. LeBlanc holds a BA in Economics from York University, a BComm from the University of Windsor and an MBA from the Schulich School of Business. He is a Chartered Accountant and Certified Public Accountant.

Experience, Qualifications and Skills:

Mr. LeBlanc has been President and Chief Executive Officer, and a director of Ambac since January 1, 2017. Mr. LeBlanc actively led global remediation and asset recovery initiatives at Syncora Holdings Ltd., evaluating strategic alternatives and overseeing all aspects of Syncora's finance function. He also served as Special Advisor to Syncora’s Board of Directors and led the successful restructuring of Syncora during the 2008-2009 financial crisis and again in its 2016 restructuring. This background gives Mr. LeBlanc substantial insight into the issues affecting Ambac and makes him a valued member of our Board of Directors.

C. James Prieur

Mr. Prieur has been a director since January 5, 2016. Mr. Prieur has over 30 years of finance, investment management, risk management, and international business experience. Mr. Prieur served as Chief Executive Officer and director of CNO Financial Group, Inc. from 2006 until his retirement in 2011. CNO Financial Group is a life insurance holding company focused on the senior middle income market in the U.S. Prior to joining CNO Financial Group, Mr. Prieur had been with Sun Life Financial since 1979. He began his career at Sun Life Financial in Investments, and in 1997 he was named Senior Vice President and General Manager for U.S. operations, and became corporate President and Chief Operating Officer in 1999, a position Mr. Prieur occupied until he left Sun Life Financial to join CNO Financial Group. While at Sun Life Financial, Mr. Prieur managed multiple lines of business, including life, annuities, and health products in the United States, Canada, the United Kingdom and Asia. Mr. Prieur is currently a director of Manulife Financial Corporation. Mr. Prieur is a Chartered Financial Analyst and has a BA from the Royal Military College and a MBA from Western University in Ontario.

Experience, Qualifications and Skills:

Mr. Prieur has over 30 years of finance, investment management, risk management, and international business experience in the insurance industry. He brings a very useful C-suite perspective into the Board room. Mr. Prieur’s experience as a former Chief Executive Officer of CNO Financial Group, Inc. and his knowledge of the insurance industry are highly valued by the Board and management. This background, as well as his financial expertise and other board experience, makes Mr. Prieur well qualified to serve on our Board of Directors and its Audit Committee and Governance and Nominating Committee, and to chair its Compensation Committee.

Jeffrey S. Stein

Mr. Stein has been Chairman of the Board since January 1, 2015 and has served as a director since May 1, 2013. Mr. Stein is Founder and Managing Partner of Stein Advisors LLC, a financial advisory firm that provides consulting services to institutional investors. Mr. Stein is an investment professional with over 25 years of experience in the high yield, distressed debt and special situations equity asset classes who has substantial experience investing in the financial services today respondedindustry. Previously Mr. Stein was Co-Founder and Principal of Durham Asset Management LLC, a global event-driven distressed debt and special situations equity asset management firm. From January 2003 through December 2009 Mr. Stein served as the Co-Director of Research at Durham responsible for the identification, evaluation and management of investments for the various Durham portfolios. From July 1997 to December 2002 Mr. Stein served as Co-Director of Research at The Delaware Bay Company, Inc., a boutique research and investment banking firm focused on the most recent public attacks made by Canyondistressed debt and special situations equity asset classes. From September 1991 to August 1995, Mr. Stein was an Associate/Assistant Vice President at Shearson Lehman Brothers in the Capital Advisors LLC (“Canyon”)Preservation & Restructuring Group. Mr. Stein currently serves as a director on the Boards of Dynegy Inc. (NYSE: DYN) and Westmoreland Coal Company (NYSE: WLB); and as a board observer on the Board of TORM plc (NASDAQ CPH: TRMD A). Mr. Stein currently

|

|

Ambac Financial Group, Inc. |19 | 2018 Proxy Statement |

serves on the Compensation and Human Resources, Corporate Governance and Nominating, and Finance and Commercial Oversight Committees of the Board of Directors of Dynegy Inc., and as chairman of the Finance and Operating Committees of the Board of Directors of Westmoreland Coal Company. Mr. Stein previously served as a director on the Boards of MLR Petroleum LLC, Granite Ridge Holdings, LLC, US Power Generating Company and KGen Power Corporation. Mr. Stein received a B.A. in Economics from Brandeis University and an M.B.A. with Honors in Finance and Accounting from New York University.

Experience, Qualifications and Skills:

Mr. Stein is an investment professional with over 25 years of experience in institutional asset management and investment research who has substantial experience investing in the financial services industry. In addition, Mr. Stein has significant experience as a corporate director and in his capacity as such has specifically focused on capital allocation, operating and financial performance, capital structure optimization, asset acquisitions and dispositions, corporate strategy, risk management and investor communications. As a result Mr. Stein has a wealth of knowledge with respect to the financial, institutional and risk management issues currently facing Ambac. His breadth of experience makes Mr. Stein well qualified to be Chairman of our Board, and to serve on the Governance and Nominating Committee.

Board Leadership Structure

The Board does not have a policy on whether or not the roles of Chief Executive Officer and Board Chair should be separate and, if they are to be separate, whether the Chair should be selected from the non-employee directors, an employee or an outsider. The Board believes that it should be free to make this choice in the manner that it deems best for Ambac at any given point in time. While the Board has no fixed policy with respect to combining or separating the offices of Board Chair and Chief Executive Officer, those two positions have been held by separate individuals for the last several years, with the position of Chair of the Board currently being filled by Mr. Stein and the position Chief Executive Officer by Mr. LeBlanc. The Board believes this is the appropriate leadership structure for it at this time.

A majority of our directors are independent, and the Board believes that the independent directors provide effective oversight of management. See “Director Independence.”

Board Committees

The current members of each of the committees of the Board, as well as the current Chairman of each of the committees of the Board, are identified in the following paragraphs. Each of the standing committees operates under a written charter adopted by the Board, which are available in the Corporate Governance section of our Investor Relations website: http://ir.ambac.com/governance.cfm. A copy of each charter is also available to stockholders free of charge on request to our Corporate Secretary, at corporatesecretary@ambac.com.

Audit Committee

The Audit Committee is currently comprised of Messrs. Haft, Herzog (Chairman), Prieur, and Ms. Lamm-Tennant. The main function of our Audit Committee is to oversee our accounting and financial reporting processes. The Audit Committee’s responsibilities include:

Selecting and approving the fees and terms of our independent registered public accounting firm's engagement.

Approving the audit, non-audit and tax services to be performed by our independent registered public accounting firm.

Evaluating the experience, performance, qualifications, and independence of our independent registered public accounting firm.

|

|

Ambac Financial Group, Inc. |20 | 2018 Proxy Statement |

Reviewing the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters.

Reviewing the design, operation and effectiveness of our internal controls and our critical accounting policies.

Reviewing with management our annual audited financial statements, quarterly financial statements, earnings releases and any other material press releases related to accounting or financial matters announcements.

Reviewing with management our major financial risk exposures and the steps that management has taken to monitor and control such exposures.

Reviewing and approving the Audit Committee report for inclusion in our annual proxy statement.

Reviewing our Regulation FD Policy.

Establishing procedures for the confidential and anonymous receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters.

Our Board has determined that each of the directors serving on our Audit Committee is independent within the meaning of the Listing Rules of NASDAQ. The Board of Directors has determined that, based on each member’s professional qualifications and experience, each of the members of the Audit Committee are financially literate and that Messrs. Haft, Herzog, and Prieur qualify as "audit committee financial experts" as defined under the rules and regulations of the SEC. The Audit Committee met twelve times in 2017.

Compensation Committee

The Compensation Committee is currently comprised of Messrs. Greene, Haft and Prieur (Chairman). The purpose of our Compensation Committee is to assist the Board in overseeing our compensation programs. The Compensation Committee’s responsibilities include:

Reviewing the overall compensation principles governing the compensation and benefits of our executive officers and other employees.

Evaluating the performance of our Chief Executive Officer.

Reviewing the procedures for the evaluation of our executive officers, other than our Chief Executive Officer.

Reviewing and approving the selection of our peer companies to use as a reference in determining competitive compensation packages.

Determining all executive officer compensation (including but not limited to salary, bonus, incentive compensation, equity awards, benefits and perquisites).

Reviewing and approving the terms of any employment agreements and severance arrangements, change-in-control agreements, and any special or supplemental compensation and benefits for our executive officers and individuals who formerly served as executive officers.

Acting as the administering committee for our stock and bonus plans and for any equity compensation arrangements that may be adopted by Ambac from time to time.

Making and approving grants of equity based awards to directors under Ambac’s compensation plans.

Reviewing and discussing with management the annual Compensation Discussion and Analysis (CD&A) disclosure, and, based on this review and discussion, making a recommendation to include the CD&A disclosure in our annual proxy statement.

Preparing the annual Compensation Committee Report for inclusion in our annual proxy statement.

|

|

Ambac Financial Group, Inc. |21 | 2018 Proxy Statement |

Each member of our Compensation Committee is an “outside” director as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended, and a “non-employee” director within the meaning of Rule 16b-3 of the Exchange Act. Our Board of Directors has determined that each of the directors serving on our Compensation Committee is independent within the meaning of the Listing Rules of NASDAQ. The Compensation Committee met eight times in 2017.

In 2017, the Compensation Committee directly engaged Meridian Compensation Partners, LLC, a nationally recognized independent compensation consulting firm, to assist it with benchmarking and compensation analyses, as well as to provide information and advice on executive compensation practices and determinations, including information on award design for both our Short Term Incentive Plan (“STIP”) and Long Term Incentive Plan (“LTIP”). From time to time, our Chief Executive Officer will attend meetings of the Compensation Committee and express his view on the Company’s overall compensation philosophy. Following year-end, the Chief Executive Officer makes recommendations to the Compensation Committee as to the total compensation package (salary, and STIP and LTIP awards) to be paid to each of our other named executive officers in the Summary Compensation Table. Our Chief Administrative Officer serves as management’s main liaison with the Compensation Committee and assists the Compensation Committee Chairman in setting the annual agenda and gathering the requested supporting material for each Compensation Committee meeting. Our Corporate Secretary serves as secretary to the Compensation Committee.

Governance and Nominating Committee